Digital Signatures in Pakistan

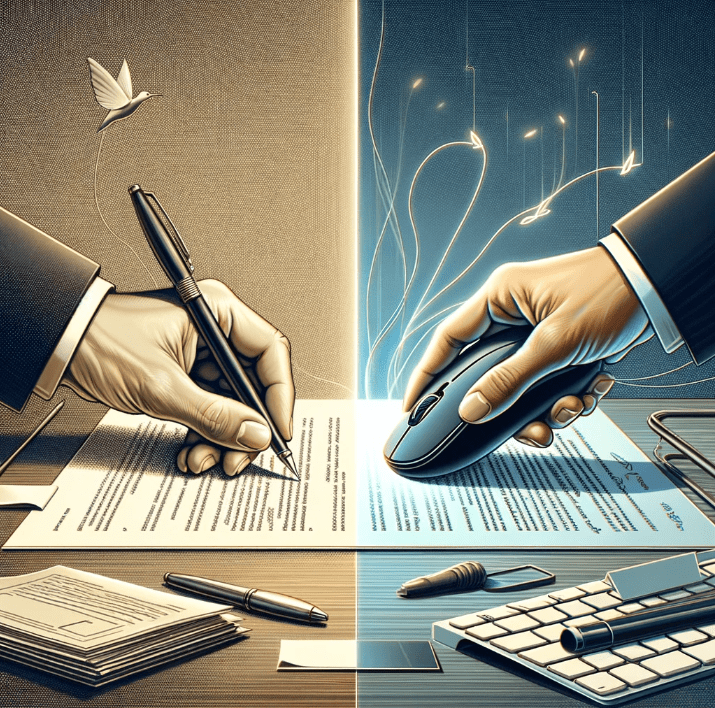

Use of Digital Signatures in Pakistan In an era where digital transformation is redefining every aspect of our lives, Pakistan stands at the forefront of legal and commercial digitalization in South Asia. At the heart of this transformation is the adoption and integration of digital or electronic signatures (e-signatures), propelled by the Electronic Transactions Ordinance (ETO) 2002. This pivotal legislation, aligned with the United Nations Model Law on Electronic Signatures of 2001, has not only facilitated the digitization of business and legal practices but also marked Pakistan as a leader in embracing digital advancements. The recent initiative by the National Database and Registration Authority (NADRA) to facilitate online Power of Attorneys represents a significant leap forward, simplifying legal procedures and enhancing accessibility. This innovative approach to legal documentation underscores Pakistan’s commitment to leveraging technology in streamlining governance and commerce, setting a precedent for digital legal processes. As we delve deeper into the legalities of e-signatures in Pakistan, it becomes evident that this digital leap is not just about adopting new technologies but also about fostering trust, efficiency, and security in electronic transactions. The ETO 2002 lays the groundwork for this digital journey, providing a robust legal framework that ensures the admissibility and recognition of e-signatures across various domains. What is an eSignature? An e-signature is the digital equivalent of a handwritten signature, applied electronically to validate and approve documents. Think of it as a secure code or tamper-proof mark linked to your identity, replacing the traditional pen-to-paper process. E-signatures come in two forms: basic and advanced. Basic e-signatures on a contract or agreement can be as simple as clicking “accept” or typing your name, while advanced versions utilize cryptography and digital certificates to offer enhanced security and non-repudiation, crucial for high-value contracts and agreements. According to Black’s Law Dictionary, the quintessential legal reference, a signature is “a person’s name or mark written by that person or at that person’s direction.” Translated to the digital realm, an e-signature fulfills this definition by serving as an electronically applied mark, uniquely linked to the signer’s identity, and used to validate and approve documents. Think of it as a secure code or tamper-proof mark replacing the pen-to-paper ritual. Enter the Electronic Transactions Ordinance (ETO) of 2002, Pakistan’s legal framework for the digital age. It recognizes two forms of e-signatures: the basic and the advanced. The basic, akin to clicking “accept” online, offers streamlined convenience for low-risk transactions. However, for high-value agreements, the advanced e-signature reigns supreme. Employing robust cryptography and digital certificates, it adheres to the ETO’s stringent requirements: unique identification of the signer, tamper-proof linkage to the document, and the ability to detect any alterations. This ensures non-repudiation, a critical legal principle ensuring the signatory cannot later deny their involvement. Digital Signatures in Pakistan: Legal Framework The foundation of e-signature utilization in Pakistan is the Electronic Transactions Ordinance (ETO) 2002, a groundbreaking piece of legislation that positions Pakistan among the early adopters of digital legal frameworks in South Asia. Formulated in alignment with the United Nations Model Law on Electronic Signatures 2001, the ETO 2002 provides a comprehensive legal basis for the recognition and use of e-signatures in both commercial transactions and legal procedures. This ordinance signifies a pivotal shift towards digitalization, ensuring that Pakistan’s legal system is harmonized with international standards. As we mentioned earlier, in the ETO 2002, e-signatures in Pakistan are distinguished into two categories: “electronic signature” and “advanced electronic signature.” The ordinance defines an electronic signature broadly, including any combination of letters, numbers, symbols, images, or characters in electronic form applied to an electronic document. This definition encapsulates the essence of e-signatures as a tool for authentication and approval, aiming to establish the document’s authenticity and integrity. The “advanced electronic signature” goes a step further, offering a higher degree of security and credibility. It is unique to the signer, capable of identifying them and created in a manner that is under their sole control. This type of signature is designed to be tamper-evident, ensuring any subsequent changes to the document are detectable. The advanced electronic signature, provided by an accredited certification service provider and recognized by the Certification Council, caters to more sensitive transactions, requiring a higher level of authentication. The ETO 2002’s framework not only legalizes e-signatures but also presumes their admissibility in courts and business dealings, a principle that greatly enhances the efficiency and reliability of electronic transactions. However, this presumption can be challenged, necessitating the authentication and certification process facilitated by the Electronic Certification Accreditation Council (ECAC) to lend credibility and certainty to e-signatures. The Role of ECAC in Pakistan’s Digital Authentication Central to the integrity and trust in e-signatures in Pakistan is the Electronic Certification Accreditation Council (ECAC), established under the auspices of the Electronic Transactions Ordinance (ETO) 2002. Operating under the Ministry of Information Technology and Telecommunication (MoITT), ECAC serves as the regulatory cornerstone for digital authentication, playing a pivotal role in the e-signature ecosystem. Its primary function is to license and regulate Certification Service Providers (CSPs) and Certifying Authorities (CAs), ensuring a secure and trustworthy digital environment for electronic transactions. The council’s responsibilities extend to auditing and regulating CSPs and CAs following the Accredited Certification Service Provider’s Audit Regulations 2008 and the Certification Service Providers’ Accreditation Regulations 2008. This regulatory oversight is critical in maintaining the integrity of digital signatures, providing a layer of security that bolsters confidence in electronic documents. Beyond Digital Certificates ECAC’s role is not merely regulatory but also foundational for the digital economy. By maintaining a repository of digital certificates issued by accredited CAs, ECAC ensures that the identity behind digital signatures can be authenticated across the digital sphere. This repository acts as a keystone in the architecture of digital transactions, enabling individuals and entities to verify the authenticity of digital certificates quickly. Furthermore, ECAC’s mandate includes granting accreditation to crypto apparatus and CSPs intending to operate as accredited entities. This accreditation process is instrumental in vetting and ensuring that the cryptographic methods and practices employed meet stringent

Digital Signatures in Pakistan Read More »

Information