Contact

Get In Touch

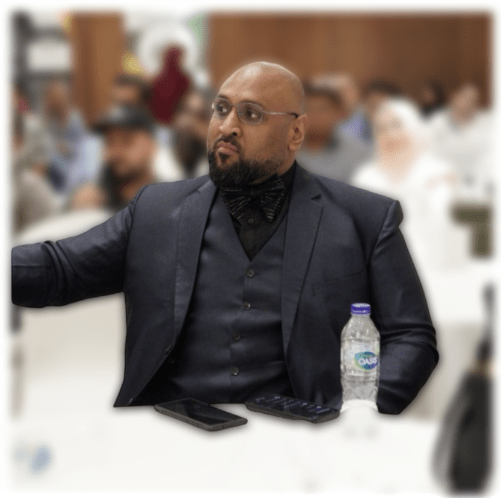

Author

Abdul Azeem

LLB (Hons) LLM

Setting Up A Business In Pakistan

Pakistan’s entrepreneurial spirit is undeniable, offering fertile ground for ambitious individuals to establish and grow their ventures. However, navigating the legal and regulatory framework can be complex, requiring careful planning and adherence to established procedures. This guide provides a roadmap for aspiring entrepreneurs, outlining the key steps involved in setting up a business in Pakistan, all from a professional and legal perspective.

The Types of Businesses You Can Register in Pakistan

The first critical step is selecting the appropriate legal structure for your enterprise. Each option, from sole proprietorship to limited liability company (LLC) and incorporated companies, possesses distinct advantages and legal implications outlined in the Companies Act, 2017, and the Limited Liability Partnership Act, 2012.

There are many options to consider when setting up a Business in Pakistan. Factors to recognize would be the number of owners, the amount of initial capital, liability, and business model.

The Types of Businesses you can set up in Pakistan are (but not limited to):-

- Sole Proprietor

- Partnership

- Private Limited Company

- Limited Liability Partnership

- Public Limited Company

- Liaison / Local Branch Office

- Not-for-Profit (Charity)

- Setting up a Business in Dubai from Pakistan

Once the structure is chosen, registration with the Securities and Exchange Commission of Pakistan (SECP) is mandatory. The SECP Act, 1997, governs this process, requiring the submission of necessary documents and adherence to established procedures. Acquiring a National Tax Number (NTN) is also essential for legal recognition and financial transactions. Remember, depending on your industry, specific licenses may be required, governed by relevant sectoral laws.

Taxation: Understanding the Financial Ecosystem in Pakistan

A thorough understanding of the Pakistani tax regime is crucial for sustainable growth. The Income Tax Ordinance, 2002, lays the foundation, followed by sales tax and professional taxes specific to your industry. Registering with the Federal Board of Revenue (FBR) and diligently filing tax returns ensure compliance and avoid financial penalties. Our legal expertise can guide you through the intricacies of the tax landscape.

Each business has its benefits and obligations to adhere to, as well as its taxation regulations. Our business lawyers, taxation lawyers, accountants, and business consultants can happily guide you on this matter.

Launching Your Pakistani Venture Remotely: A Guide for International Entrepreneurs

The entrepreneurial spirit in Pakistan beckons to ambitious individuals worldwide. But how do you establish a thriving business there while physically located elsewhere? The answer lies in leveraging Pakistan’s welcoming investment climate and utilizing streamlined remote business setup options.

Partnering with a reputable local lawyer or business consultant unlocks a wealth of resources. They can guide you through the efficient company incorporation process, ensure regulatory compliance, and even provide virtual office solutions. Submitting documents, registering your business, and acquiring necessary licenses can all be achieved remotely, allowing you to plant your entrepreneurial roots without needing to be physically present. Continuous communication with your Pakistani partners and advisors remains crucial for navigating the nuances of the market and ensuring smooth operations.

Cultivating International Brands on Pakistani Soil: Exploring Franchise Opportunities

Established international brands looking to expand their reach often find fertile ground in Pakistan’s burgeoning consumer market and growing desire for Western offerings. Franchise presents a lucrative opportunity, allowing you to leverage your established business model and brand recognition while capitalizing on local expertise. However, meticulous planning is paramount.

A thorough analysis of the Pakistani market is essential. Tailor your offerings to local preferences and regulations, ensuring your brand resonates with consumers. Partnering with our reputable franchise consultant with deep knowledge of the local landscape can be invaluable. They can navigate legalities, identify suitable franchise partners, and guide you through the intricacies of market entry. By combining meticulous planning with cultural sensitivity, your international brand can flourish on Pakistani soil, cultivating mutually beneficial success alongside your local partners.

Other things to Consider when setting up a Business in Pakistan

Building a lasting business empire requires deliberate initial planning. Several crucial factors need careful consideration before embarking on your entrepreneurial journey:

1. Business Model: The chosen structure influences numerous aspects, including legal requirements, tax implications, and operational complexities. Whether you opt for a sole proprietorship, a partnership, or a limited liability company (LLC) will depend on your specific needs and goals.

2. Target Customer Base: Understanding your ideal customer’s location, demographics, and purchasing habits is essential for tailoring your offerings, marketing strategies, and pricing models. Are you targeting local customers within Pakistan, a broader regional audience, or a global market?

3. Product/Service Offering: The nature of your offering, whether tangible goods, digital products, or software services, significantly impacts logistics, licensing requirements, and intellectual property considerations. Clearly define your value proposition and ensure it aligns with your target market and chosen business model.

By meticulously considering these foundational elements, you lay the groundwork for a robust and sustainable business empire. Remember, seeking professional guidance from lawyers, accountants, and industry experts can help navigate legal complexities and optimize your approach for long-term success.

Contracts and agreements will no doubt play a huge part in any business. Managing human Resources (Whether Outsourcing, Contracting, or Employing employing staff) would bring its realm of liability to any organization. Intellectual property, trademark registration, and tax are all elements one must be aware of when starting or running their business.

Compliance and Responsible Growth

While focusing on growth, remember the legal framework that governs your operations. Labor laws, environmental regulations, and safety standards, outlined in relevant legislation and overseen by respective regulatory bodies, ensure your business operates ethically and responsibly.

Engaging with industry associations and chambers of commerce, facilitated by regulations like the Trade Organizations Act of 2013, fosters a supportive ecosystem for your venture.

Need Help on Setting Up Your Business in Pakistan?

Our panel of skilled business and corporate lawyers in Pakistan specializes in company formation in Pakistan and Company company formation in Dubai and offers personalized advice and robust legal solutions.

- AI Legal Site: For general information, visit 24Justice.com—Pakistan’sfirstt legal AI site.

- Personalized Assistance: For more specific queries or legal representation, reach out to us:

- Call: 92 308 5510031

- WhatsApp: 0092 308 5510031

- Contact Form: Prefer writing? Fill out our contact form below, and we’ll respond promptly.

We Help You Solve Your Legal Issues

At 24Justice, we believe that everyone deserves access to justice, and we are committed to making that belief a reality. Choose 24Justice, and take the first step towards navigating your legal journey with confidence and ease.